U.S. Economy Surges 3% in Q2 Despite Tariff Pressures, Surpassing Forecasts

- Rahaman Hadisur

- Jul 31, 2025

- 2 min read

Hadisur Rahman, JadeTimes Staff

H. Rahman is a Jadetimes news reporter covering Business

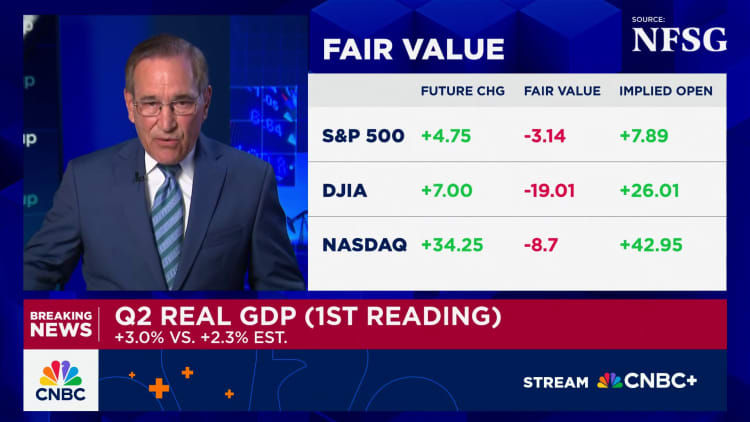

The U.S. economy grew at a robust 3% annual rate in the second quarter of 2025, defying forecasts and demonstrating unexpected resilience amid ongoing trade tensions and tariff policies introduced by President Donald Trump.

The Commerce Department’s latest GDP report revealed a stronger than anticipated rebound from a weak first quarter, which had seen a 0.5% contraction. Analysts had projected a modest 2.3% gain for Q2, but consumer strength and a sharp drop in imports drove the upside surprise.

“This summer’s word for the economy is ‘resilient,’” said Heather Long, chief economist at Navy Federal Credit Union. “The consumer is hanging in there, but still on edge until the trade deals are done.”

Key Highlights from the GDP Report:

GDP growth: 3% in Q2, up from -0.5% in Q1

Consumer spending: Increased by 1.4%, compared to just 0.5% in Q1

Imports: Fell 30.3%, reversing a 37.9% surge in the prior quarter

Exports: Declined by 1.8%

Federal government spending: Dropped 3.7%

Residential investment: Fell by 4.6%

The data suggests a temporary boost from reduced imports, which contributed positively to the GDP calculation, even as exports and residential investments faltered.

President Trump, who earlier this year imposed new tariffs on key trading partners, celebrated the GDP numbers but renewed his pressure on the Federal Reserve to cut interest rates. “2Q GDP JUST OUT: 3%, WAY BETTER THAN EXPECTED!” Trump posted on Truth Social. “‘Too Late’ MUST NOW LOWER THE RATE. No Inflation! Let people buy, and refinance, their homes!”

While core inflation remains slightly above the Federal Reserve’s 2% target with core PCE rising 2.5% in Q2 the overall trend indicates easing inflation pressures. The Fed, set to meet later Wednesday, is expected to hold its benchmark rate steady at 4.25% to 4.5%.

Despite the strong headline number, some economists warn that the growth may be unsustainable. Final sales to private domestic purchasers a key demand indicator rose just 1.2%, the slowest pace since Q4 2022.

Kevin Hassett, director of the National Economic Council, dismissed recession concerns: “The anti-Trump story has been that tariffs would lead to a depression. But every part of this GDP release shows strength.”

However, others, like market analysts at Goldman Sachs, have expressed caution about a potential economic slowdown in the second half of the year, particularly if trade tensions escalate or interest rates remain elevated.

With trade negotiations ongoing and mortgage rates still high, the housing sector remains a weak point. Still, the government’s limited role in driving Q2’s growth with federal outlays down and state and local spending up only modestly suggests underlying private sector momentum.

As the 2025 presidential race heats up, Trump’s economic team is likely to seize on these figures as validation of his trade strategy. However, economists and the markets will be watching closely to see whether the momentum can be sustained in the face of global uncertainty and policy headwinds.

Comments